Top 5 Cryptocurrency AI Tokens to Watch in 2025

The convergence of artificial intelligence and blockchain technology has propelled AI-driven cryptocurrency tokens into the spotlight, marking a transformative era in the crypto market. As of 2025, the market capitalization of AI and big data tokens has skyrocketed to over $36 billion, a remarkable leap from $2.7 billion in 2023, driven by increasing demand for decentralized AI solutions. This article explores the top five AI cryptocurrency tokens to watch in 2025, ranked by their market capitalization, growth potential, and market hype. These tokens represent cutting-edge projects that blend AI’s computational capabilities with blockchain’s transparency, offering innovative applications and capturing significant investor interest.

1. Artificial Superintelligence Alliance (FET)

The Artificial Superintelligence Alliance, trading under the ticker FET with a market cap of approximately $3.3 billion in 2025, is a leading force in the AI crypto space. Formed through the merger of Fetch.ai, SingularityNET, and Ocean Protocol, FET powers a decentralized AI ecosystem where autonomous economic agents handle tasks like supply chain optimization and predictive analytics.

2. Bittensor (TAO)

Bittensor (TAO), with a market cap of around $2.4 billion as of June 2025, is redefining decentralized AI through its innovative machine-learning network. Often dubbed a “digital hive mind,” TAO incentivizes collaborative AI model training, allowing users to contribute to and access a shared pool of machine intelligence. Its Proof-of-Intelligence consensus rewards valuable contributions, driving adoption among developers and AI enthusiasts.

TAO’s price surged 164% in 30 days in 2024, fueled by venture capital from firms like Polychain and listings on major exchanges like Binance. With a very high growth potential driven by its scalable subnets and unique technology, TAO is a standout in the AI crypto sector. Its strong community engagement and social media buzz further amplify its appeal.

Check TAO’s Shariah status at Sharlife’s TAO analysis.

3. NEAR Protocol (NEAR)

NEAR Protocol, holding a market cap of about $2.6 billion in June 2025, is a layer-1 blockchain designed for high-speed decentralized applications, including AI-driven ones. With sharding enabling up to 100,000 transactions per second and 1.2-second finality, NEAR is well-suited for real-time AI agent transactions.

4. Internet Computer (ICP)

The Internet Computer (ICP), with a market cap of roughly $2.6 billion in June 2025, aims to decentralize the internet by hosting websites and dApps on a network of independent servers. Its native token, ICP, powers governance and operations, with recent AI tool launches like Caffeine boosting its relevance.

Trading at $4.89 after an 8.8% breakout from a seven-month downtrend, ICP shows signs of recovery, though it’s far from its 2021 peak of $428. Its moderate growth potential is tied to its vision of a decentralized internet, but regulatory risks and competition from cloud providers pose hurdles. While ICP’s hype is growing, it trails FET and TAO in social media buzz. Its blend of Web3 and AI innovation makes it a token to watch, with Shariah status details available at Sharlife’s ICP analysis.

5. Render Network (RNDR)

Render Network (RNDR), with a market cap of approximately $1.3 billion in July 2025, is a decentralized GPU rendering platform built on Ethereum, addressing the growing need for computing power in AI and creative industries. RNDR enables node operators to lease GPU resources for tasks like animation, VFX, and machine learning, with integrations in tools like Blender and Houdini driving adoption.

Trading at $3.21, RNDR’s bullish momentum, crossing key EMAs, suggests potential to retest the $9+ region. Its high growth potential is fueled by the surging demand for decentralized computing, amplified by Nvidia’s dominance in AI hardware. Though its hype is moderate compared to FET or TAO, RNDR’s niche use case and technical upgrades like RNP-019 position it for significant growth.

For RNDR’s Shariah compliance, see Sharlife’s RNDR analysis.

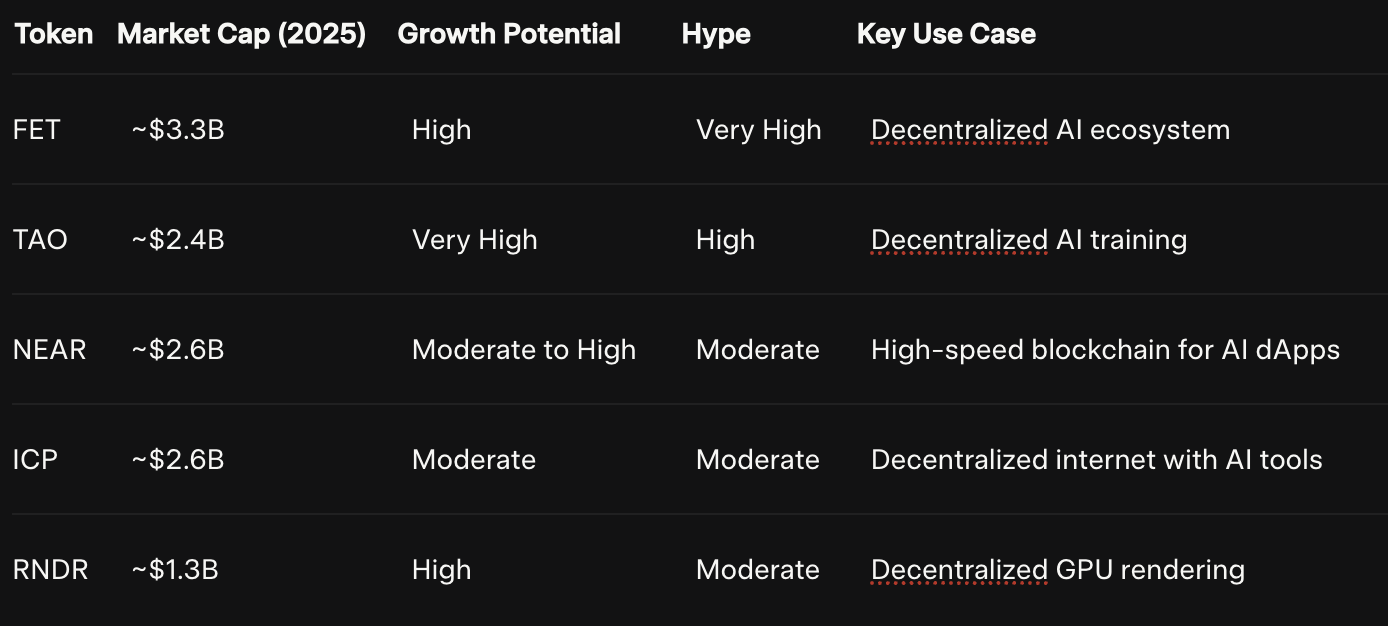

Comparison of Top AI Tokens

Conclusion

The AI cryptocurrency sector in 2025 is vibrant, with tokens like FET, TAO, NEAR, ICP, and RNDR showcasing diverse applications, from decentralized AI ecosystems to GPU rendering networks. Each token offers unique strengths but also faces challenges like market volatility and regulatory uncertainties. Investors should carefully evaluate these opportunities, considering both their innovative potential and inherent risks. This ranking, based on market cap, growth potential, and hype, is not a buy recommendation but a guide to the most promising AI tokens. To understand their Shariah compliance, refer to the provided Sharlife links. Always conduct thorough research before investing in this dynamic and rapidly evolving market.