Nasdaq-listed Greenpro Capital Corp. has received conditional approval from the Labuan Financial Services Authority (Labuan FSA) to launch an Islamic digital bank under the Labuan International Business and Financial Centre (Labuan IBFC) framework. The approval comes under Labuan FSA Guidelines on the Establishment of Islamic Digital Bank released last year and allows Greenpro to move forward with its proposal to create what it says will be a Shariah compliant digital bank capable of accepting both fiat and cryptocurrency deposits. The planned Green Digital Bank will support operations between fiat currencies and crypto assets while fully aligned with Islamic finance principles and the Labuan IBFC framework.

Koperasi Media Prima Bhd (Kopmedia) has signed a memorandum of understanding (MoU) with Bank Islam Malaysia Bhd to pursue collaborative initiatives and business opportunities. The partnership is intended to create mutual value, particularly in areas related to cooperative financing and investment.

Syria will be fully reconnected to the Swift international payment system "in a matter of weeks", the country's new central bank governor said, relinking the country to the global economy after 14 years of war and sanctions that rendered it a pariah state.

The global sukuk market for Islamic finance faces a pivotal moment. A new framework from the Accounting and Auditing Organization for Islamic Financial Institutions threatens to destabilise a $1tn market that has become a vital funding source for sovereigns and corporates across the Middle East, Asia and beyond.

Global Islamic finance assets will reach $7.5 trillion by 2028, up from $5.5 trillion in 2024, reflecting the rapid expansion and growing relevance of Shariah-compliant finance in global markets, says Standard Chartered's new report on Islamic banking.

Wall Street's main indexes slipped on Monday, with technology stocks falling as Treasury yields spiked after Moody's downgraded the US sovereign rating, sharpening focus on its mounting debt. Moody's cut the United States' sovereign credit rating to "Aa1" from "Aaa" late on Friday owing to concerns about its ballooning US$36-trillion (RM154.6-trillion) debt, becoming the last of the three major credit rating agencies to downgrade the country. It had first given the US its pristine "Aaa" rating in 1919.

In a landmark move for ethical finance and fintech advancement, OGold, the UAE’s leading digital gold investment platform, has partnered with Mawarid Finance, a premier UAE-based Shariah-compliant financial institution established in 2006, to jointly develop and launch the region’s first Shariah-compliant prepaid card backed by physical gold.

As Malaysia advances its ambition to become a leading hub for sustainable finance, new platforms such as the Bursa Carbon Exchange (BCX) are taking centre stage. Financial institutions, including CIMB, are actively participating, signalling a national commitment to climate action. While carbon markets introduce opportunities, they also raise significant ethical questions that demand careful consideration from an Islamic finance perspective. Do these instruments truly align with Shariah principles, or do they present a modern ethical challenge?

Bank Rakyat has launched the eGold Account-I, a shariah-compliant digital gold investment accessible via its internet banking platform. The account allows investors to own gold of quality 999.9 accredited by the London Bullion Market Association, with prices starting as low as RM10, Bank Rakyat said in a statement. The account offers real-time trading, and customers have the option to convert their digital holdings into physical gold.

Cryptocurrency exchange Bitget discovered "abnormal trading activity" on the VOXEL/USDT perpetual futures contract on April 20, between 8:00 to 8:30 UTC, and paused accounts that the exchange suspected of market manipulation.

Malaysia's manufacturing investments and expansion plans are expected to be delayed amid uncertainties over the US tariff rate on Malaysia, said Affin Hwang Investment Bank Bhd.

He attributed this to Qatar's strategic location, the rising demand for Islamic financial services and products, a conducive operational environment, and a robust regulatory and legislative framework that supports the sector.

Stocks dived, bonds surged, the dollar rose and Asia's markets were set to slide on Thursday as U.S. President Donald Trump announced a bigger-than-expected wall of tariffs around the world's largest economy, upending trade and supply chains. Nasdaq futures tumbled 4%, with tech on the front line because China - hit with a 34% levy on top of a previous 20% tariff - is such a significant manufacturing hub. Apple shares were down nearly 7% in after-hours trade.

Gold prices are on fire! The precious metal continues to defy expectations, repeatedly smashing record highs as investors seek refuge from global economic turbulence. To recap, on Oct 30, 2024, gold surged to an all-time high of US$2,787.61 (RM12,324) per troy ounce before settling at US$2,693.23 per troy ounce in January 2025.

Bank Negara Malaysia (BNM), in collaboration with the Ministry of Health (MOH) and the Employees Provident Fund (EPF), will take steps to develop basic health insurance and takaful products that emphasise the concept of value-based healthcare, said Deputy Prime Minister Datuk Seri Dr Ahmad Zahid Hamidi. "This initiative is part of the national health sector reform effort that needs to be implemented immediately to ensure access to more sustainable medical treatment," he said in a statement.

Despite surprise rate cuts in some Asean countries due to weak domestic demand, Malaysia is expected to maintain its overnight policy rate (OPR) at 3% throughout 2025, as analysts cite resilient economic fundamentals and fiscal reforms.

Malaysia and Bahrain are expected to sign several new collaborations, including in the field of Islamic financial technology, by May this year, says Datuk Seri Anwar Ibrahim. The Prime Minister said that the focus on Islamic financial technology using advanced instruments was among the agreements reached between the two parties.

Luno has become the first regulated digital asset exchange in the world to offer Shariah-compliant Ethereum (ETH) staking. This landmark certification is designed to make cryptocurrency investments more accessible and aligned with Islamic principles, particularly for Muslim investors in Malaysia.

KUALA LUMPUR The Zakat Collection Centre of the Federal Territory Islamic Religious Council (PPZ-MAIWP) has become the first zakat agency in Malaysia to integrate modern technology into its zakat payment system.

The Eurasian Development Bank (EDB), the Islamic Development Bank Institute (IsDBI) and the London Stock Exchange Group (LSEG) have joined forces to spotlight the rapid development of Islamic finance in Central Asia.

Bitcoin is challenging conventional financial systems and offers Muslims an alternative to interest-based money that aligns with Islamic principles, experts have told the Bitcoin Mena conference held at Adnec in Abu Dhabi.

Murex has announced that KuwaitÃÂâÃÂÃÂÃÂÃÂs Boubyan Bank has completed MX.3 platform implementation for Sharia-compliant treasury activity.

According to CoinMarketCap, Ripple's native XRP token has a maximum supply of 100 billion and a circulating supply of roughly 57 billion.

BANK Negara Malaysia has directed insurers and takaful operators (ITOs) to reassess their repricing strategies for medical and health insurance and takaful (MHIT) products to ensure a more reasonable implementation.

According to PANews, DBS Hong Kong has announced that its Treasures and Private Banking Treasures clients can now engage in cryptocurrency ETF trading through the DBS Digibank application. This development marks a significant step in the bank's digital asset offerings.

Wahed currently manages over $1 billion in assets and has attracted over 400,000 clients worldwide. The company is built on the principles of democratizing access to financial services and offers clients access to Shariah-compliant investments in its mobile app. Wahed removes the barriers to sophisticated investment management services that have been traditionally reserved for high-net-worth investors.

Webull Malaysia, a subsidiary of Webull Corporation, has introduced an Islamic banking channel. The company claims to be the first fully online retail brokerage in the country to offer Shariah-compliant funding options for trading Malaysian and U.S. stocks.

Bitcoin's march toward $100,000 made further ground on Thursday as investors bet a friendlier U.S. regulatory approach to cryptocurrencies under President-elect Donald Trump will unleash a boom era for the asset class.

Binance added new trading pairs, including PNUT/BRL and PNUT/EUR. PNUTâÂÂs price has surged 1,400% in two weeks, fueled by the companyâÂÂs initial support and Elon MuskâÂÂs endorsements.

Islamic financial services provider Hejaz has launched Australia’s first halal financial app to offer Australia’s growing Muslim community convenient and straightforward access to a broad range of Shariah-compliant financial products and services.

Abu Dhabi Islamic Bank-Egypt (ADIB-Egypt) received Global Finance Magazine’s "Best Islamic Financial Institution in Egypt" award for the seventh consecutive year, marking the bank’s ongoing pioneership in excellence and leadership.

As Islamic finance continues to grow, both financial education and innovative investment products are paving the way for a new era of Sharia-compliant wealth management and private banking.

Meezan Bank, Pakistan’s leading Islamic bank is pleased to announce a new strategic partnership with the International Islamic Trade Finance Corporation (ITFC) (www.ITFC-IDB.org), a member of the Islamic Development Bank (IsDB) Group, under the ITFC Letter of Credit (LC) Confirmation product

KUALA LUMPUR: Islamic finance holds substantial potential to revitalise the economy through three core principles-Maqasid Shariah, innovation, and global integration, said Bank Negara Malaysia (BNM). BNM Governor Datuk Seri Abdul Rasheed Ghaffour outlined these principles as embedding Maqasid Shariah in economic and sustainable reforms, advancing innovation for value-based solutions, and enhancing global integration for mutual development and shared prosperity.

Financial Secretary Paul Chan says Hong Kong is ready to relaunch its drive to develop Islamic finance after a three-day trip to the Saudi capital Riyadh opened his eyes to the untapped potential of developing more financial products that comply with Islamic law.

The GCC’s Shariah-compliant institutions are growing their assets and expanding their reach, thanks to new strategic partnerships and greater tech investment.

Jakarta - Bank Indonesia Governor Perry Warjiyo emphasized five main factors in building the progress of the Islamic financial market. One is developing Green Sukuk or State Sharia Securities (SBSN).

Fiona Bassett, CEO of FTSE Russell, part of the London Stock Exchange Group, highlighted the UAE's leading role as a beacon of financial innovation in the Middle East and its position as a leading centre for Islamic finance.

Blade Labs, the Qatar-based tech company focused on blockchain and Web3, recently unveiled a platform for tokenized Islamic finance contracts also known as Murabaha contracts. This platform will reportedly enable lenders to target a wider customer base without violating Sharia principles.

KARACHI: The Global Shari’ah Majlis, a highly anticipated event in the Islamic finance industry, was held on Wednesday, hosted by Standard Chartered Bank.

The ringgit extended positive momentum to trade higher against the US Dollar in the early session today, supported by continued buying demand as more investors shifted to currencies from emerging countries, including the ringgit, an analyst said.

When billionaire Warren Buffett speaks, Wall Street tends to pay very close attention. In his nearly six decades as CEO of Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B), he's overseen close to a 5,600,000% cumulative return in his company's Class A shares (BRK.A). Few money managers have been able to consistently outpace the benchmark S&P 500 (SNPINDEX: ^GSPC) quite like Buffett.

Gamuda Bhd has partnered with OCBC Bank (Malaysia) Bhd and OCBC Al-Amin Bank Bhd (collectively OCBC Malaysia) for its inaugural shariah-compliant sustainability-linked financing facility with an embedded sustainable derivative solution.

The anticipation of a further increase in overnight policy rate (OPR) by the central bank at the end of the month has triggered concern among many who fear for the state of their household finances.

Permodalan Nasional Bhd’s (PNB) newly launched Wakaf ASNB has hit RM30 million in funds and is slated for its maiden dividend distribution in the first half of 2023, said president and chief executive Ahmad Zulqarnain Onn.

Nigeria is anticipating the listing of 50 Shariah-compliant products with a market value of NGN 5 trillion (USD 2.2 billion) between now and 2025, as per a statement made by Lamido Yuguda, the Director General of the Securities and Exchange Commission (SEC), on the 7th of December 2022.

Al Kawthar Leasing Company – a private shareholding company owned by Arab Jordan Investment Bank – AJIB, selected ICS BANKS Finance Leasing Solution from ICS Financial Systems – ICSFS, the global software and services provider for banks and financial institutions.

The US securities regulator on Thursday (Dec 8) advised public companies to examine whether they need to disclose to investors any potential impacts from turmoil in the cryptocurrency industry.

Emirates Islamic Business Banking was recognised for its innovative proposition for small and medium enterprises (SMEs) and its status as a preferred bank for entrepreneurs seeking Shariah-compliant products and services for their businesses

LOLC Al-Falaah was felicitated with two prominent awards within the Islamic Banking and Finance services sector in Sri Lanka, at the 11th edition of the SLIBFI (Sri Lanka Islamic Banking and Financial Institution) awards. Securing the Gold award for ‘Leasing Company of the Year’ and Gold award for ‘Window of the Year’ were significant, as LOLC Al-Falaah have won these awards consecutively over the years.

Bank Nizwa, the leading and fastest-growing Islamic Bank has recently been awarded the 'Islamic Bank of the Year' title and 'Best Sustainable Banking Products Innovation' accolade at the Alam Al Iktisaad's Islamic Banking and Finance Summit (IBFS) 2022. Held under the patronage of His Highness Sayyid Fehr Bin Fatik Al Said, His Excellency Tahir Al Amri, Executive President of the Central Bank of Oman, was the Guest of Honour and keynote speaker. Bank Nizwa was the event's Presenting Sponsor, which was organised on the 29th of November at the Crowne Plaza, Qurum.

In acknowledgment of its commitment to sustainability, Islamic Coin, ethics-first digital money that complies with Shariah law, has won Most Promising ESG Crypto at the MEBA awards.

Despite the global economy being ravaged by turmoil induced by the Covid-19 pandemic over the last couple of years, the Islamic finance industry has emerged relatively unscathed

Within the framework of QIIB’s role in spreading the principles of Islamic banking and economics, QIIB provided a sponsorship for the Islamic Finance Conference, that was recently held at Harvard University under the theme “Waqf and Philanthropic Foundations: Shared Values for Socio-Economic Development”.

Islamic finance is likely to continue growing over the medium term in Bangladesh âÃÂàdriven by rising public demand, new branch openings, and supportive government policies, said a report by US-based credit rating agency Fitch Ratings.

11th Global Islamic Microfinance Forum was successfully concluded at Metropolitan Hotel Dubai, UAE under the patronage of AAOIFI Bahrain. The purpose of that forum was to promote, strengthen and unite the organizations of Islamic microfinance (IsMF) with the theme of financial Inclusion, outreach strategies & innovations.

Dubai Islamic Bank (DIB), the largest Islamic bank in the UAE and a leading powerhouse in the world of Islamic Finance, hosted the 2022 Trade Club Alliance (TCA) General Assembly at an exclusive event, held on the 14th and 15th of November 2022 at the Sofitel Dubai The Obelisk.

Furthering its objective to be a key player in Oman’s Islamic financing industry, ahli islamic sponsored the recently concluded first-of-its-kind Al Roya Islamic Banking Conference, as a key contributor to the success of the event.

Stocks related to gaming and alcohol slumped in Malaysia after an Islamic party garnered the most seats at the countryâs elections on Saturday, paving the way for an alliance itâs a part of to form the next government.

Azentio Software ("Azentio"), a Singapore-headquartered technology firm owned by funds advised by Apax Partners, announced today that it has won the 'Excellence in Islamic Banking Solutions' award at Finnovex Saudi Arabia 2022, for the Azentio ONEBanking Islamic Software Suite, an industry-leading technology and best-selling Islamic core banking suite globally.

The Bored Ape Yacht Club (BAYC) community didn’t have a pleasant start to the week, as some of the users have fallen prey to a hack. Some of the users seem to have lost their NFTs through a fake mint link that was sent out to the followers.

Al Rajhi Bank Malaysia (ARBM), a subsidiary of Al Rajhi Bank of the Kingdom of Saudi Arabia, has selected Moneythor, a digital banking solution provider to implement innovative personal financial management (PFM) features in its upcoming digital bank in Malaysia.

A former Chief Executive Officer of Stanbic Bank, Naa Alhassan Andani, has appealed to stakeholders in the Muslim communities to provide financial support for the establishment of an Islamic Bank to address the financial needs of all Muslims.

Global offerings of sukuk are off to their busiest start on record this year, with bankers at HSBC Holdings Plc and Deutsche Bank AG citing the high price of oil as a driver of the vibrant issuance.

Luxembourg remains the European leader in the domiciliation of Islamic funds. But the sector has changed little since 2016 and is now facing competition from other financial hubs. The market is less buoyant than expected, due to the lack of local roots.

Deloitte Middle East was the lead financial adviser to the consortium of Acciona Agua, Tawzea and Tamasuk on three Independent Sewage Treatment Plants (ISTPs) procured by the Saudi Water Partnership Company.

Islamic finance pioneer Malaysia is looking for new drivers to reignite growth for its $286 million industry. Sustainable finance and digitization of services will lead the way, with lenders expected to adopt technologies such as artificial intelligence and big data to break into under-served markets, said Bank Negara Malaysia Assistant Governor Adnan Zaylani Mohamad Zahid.

The Abu Dhabi Islamic Bank (ADIB) has revealed the provision of $61 million in financing for green-certified projects in Saudi Arabia.

LACK OF research, data and insufficient information in Islamic finance industry are seen as the key challenges that stagnate the industry, says Islamic Development Bank VP finance and CFO Dr Zamir Iqbal.

JAKARTA - Indonesia sold 2.8 trillion rupiah ($195.04 million) worth of Islamic bonds in a biweekly auction on Tuesday, the finance ministry said, below a 9 trillion rupiah target.

PETALING JAYA: Islamic financial technology (fintech) holds immense potential to serve consumers that are unbanked, uninvested and uninsured, according to Malayan Banking Bhd (Maybank) chairman Tan Sri Zamzamzairani Mohd Isa.

KUALA LUMPUR (March 21): The lack of data is one of the main reasons for the slow adoption of environmental, social and governance (ESG) principles among Islamic finance institutions. Responsible Finance and Investment Foundation (RFI) chief executive officer Blake Goud said there is a need for players to take the first step.

Law students and lawyers in Afghanistan are filing reports with JURIST on the situation there after the Taliban takeover. Here, a Staff Correspondent for JURIST in Kabul reports on recent changes to laws affecting the banking and financial sector of Afghanistan.

Speakers of an Islamic Financial Literacy summit hosted by International Islamic University Islamabad (IIUI) here on Thursday, opined that there is a sheer need of promoting the Islamic finance with an increased outreach to a wider segment of society. They recommended that instead of long term finance to the new entrepreneurs and SMEs equity must be promoted.

Dubai: From being a pioneer Islamic financial institution, the first in the world to today, the largest Islamic bank in the UAE and the second largest the world over, Dubai Islamic Bank (DIB) has been rapidly transforming itself to keep up with the ever-evolving world.

Muslims are changing their perspectives on halal and haram stocks following online education courses.

RIYADH: Saudi Arabia's National Debt Management Center has closed the March 2022 issuance of Saudi riyal-denominated sukuk, valued at SR10.3 billion ($2.75 billion).

Palm oil producer Kuala Lumpur Kepong Bhd (KLK) has issued RM2 billion worth of Islamic bonds or sukuk through two tranches under its Islamic Medium-Term Notes (IMTN) programme of up to RM2 billion.

The Ministry of Finance (MoF) has committed up to RM50 billion in financing for the Mass Rapid Transit 3 (MRT3) Circle Line project, whose initial estimated construction cost is RM31 billion plus land acquisition of RM8 billion.

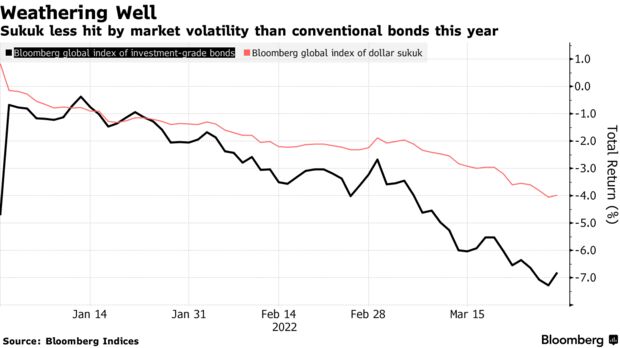

An important financial instrument in Islamic and non-Islamic countries alike, the sukuk market has been marginally affected by global uncertainty so far.

Acciona, the Spanish conglomerate, together with its local partners Tawzea and Tamasuk, has closed green loans totaling $480 million for three independent sewage treatment plants (ISTPs) in Saudi Arabia.

Studies of lived religion among Muslims in Europe increasingly analyse how Muslims’ everyday practices are informed by religious beliefs, norms and values. This includes studies about food preparation, hijab fashion and shopping. Yet, religious influence on the economic aspects of Muslims’ everyday lives remains largely unexplored.

Alkhabeer Capital, a Saudi-listed Islamic investment and advisory firm, has kick-started the initial public offering (IPO) of its Shariah-compliant fund.

JAKARTA, March 13 (The Straits Times/ANN): Newly established tech-based lenders are enthusiastically tapping into syariah banking in Indonesia, betting on an underpenetrated market with a potential customer base of 45 million in a country with the world's largest Muslim population.

The Indian Ocean archipelago Maldives is developing an Islamic finance sector, although it may need to strengthen legislation and local turnover to attract sufficient international players to develop an offshore hub.

KUALA LUMPUR (March 8): Agrobank has launched a special campaign aimed at empowering women agropreneurs, offering takaful coverage worth RM10 million in conjunction with the International Women's Day 2022.

The volume of Islamic banking in Egypt amounted to about EGP 429bn in 2021, representing about 5% of the total size of the Egyptian banking market, an increase of EGP 63.6bn from 2020, with a growth rate of 17.4%, according to a report from the Egyptian Islamic Finance Association (Eifa).

MALAYSIA is gearing up to be the global leader in Islamic FinTech, with these companies paving the way forward. According to Dinar Standard's Global Islamic FinTech Report 2021, the Islamic FinTechmarket is projected to grow to US$128 billion (RM536 billion) by 2025.

Wahed, a financial investment company that aims to advance financial inclusion through accessible, affordable, and values-based investing, will debut the Nasdaq's first Shariah-compliant and ESG-aware ETF today.

Murabaha and Tawarruq contracts prompted a 19 percent annual rise in total financing provided by Saudi Islamic banks as of Sep. 30 2021.

Shaheen H. Al-Ghanem, CEO of Warba Bank, a leading Kuwaiti Islamic Bank, Tuesday rang the market-opening bell to celebrate the listing of the Bank's US$250 million perpetual Tier-1 Sukuk on Nasdaq Dubai, in the presence of Hamed Ali, CEO of Nasdaq Dubai and Dubai Financial Market (DFM).

The global Islamic capital market's growth next year is hinged on the pace of policy revisions by major central banks and stable Sukuk issuances, says Standard and Poor's Global Ratings Islamic Finance global head Mohamad Damak.

The Islamic Development Bank Institute (IsDBI) (www.IsDBInstitute.org) and the Islamic Financial Engineering Laboratory (IFE Lab) have announced winners of the second edition of the International Award for the Best Application of Agent-Based Simulation (ABS) in Islamic Economics and Finance.

Sharlife, an Islamic Finance comparison website has been launched in Malaysia. The platform aims to provide information on Shariah Compliant financial products by Islamic banks and Takaful operators.